Wall Street traders pushed stocks to new all-time highs as the United States Federal Reserve signalled it’s on course to lower interest rates for the first time since the start of the pandemic.

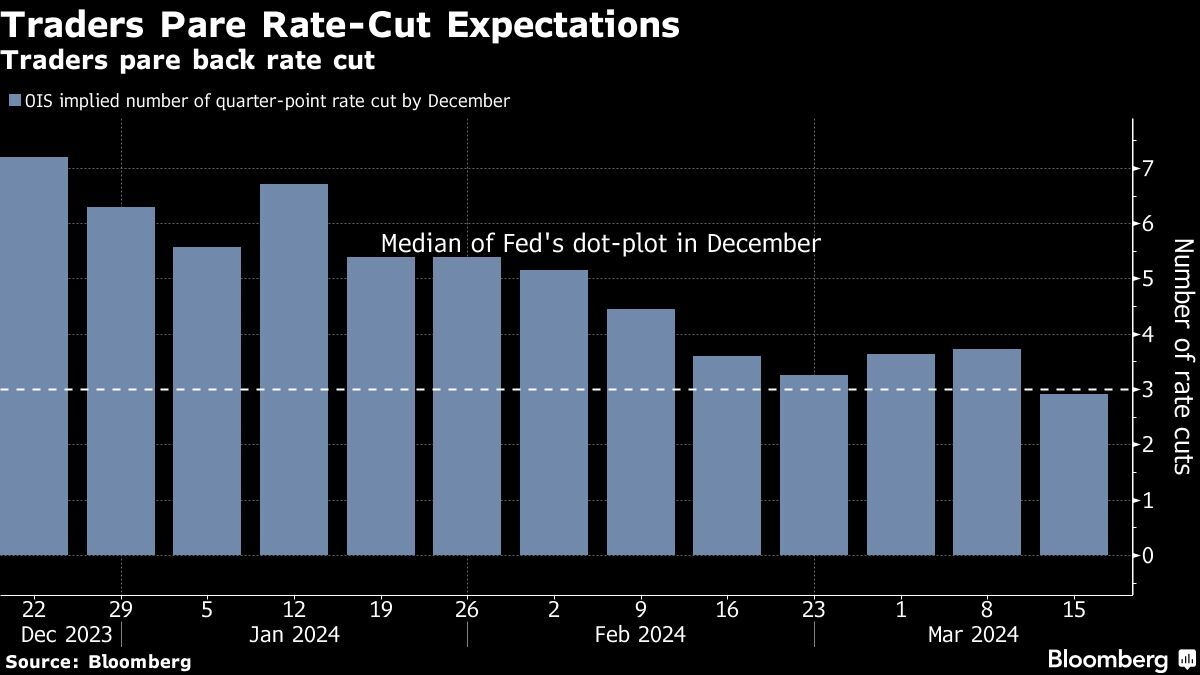

In a groundbreaking move, the S&P 500 surpassed 5,200 based on speculation that the conclusion of the most-aggressive Fed hiking cycle in a generation will continue to drive corporate profits. Increases in stocks were nearly across the board, with sectors that have been lagging behind this year — like small caps — making strong gains. Short-term Treasuries performed well, with traders now foreseeing a greater chance of the first Fed action in June.

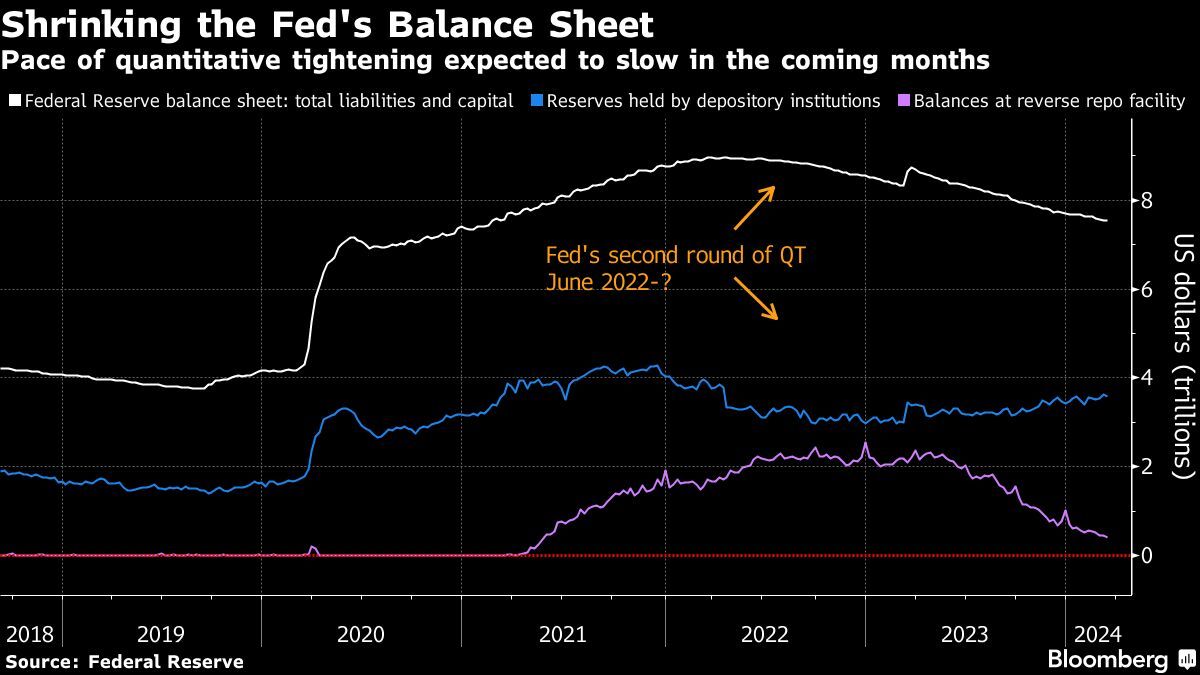

Policymakers maintained their projection for three cuts in 2024 and moved towards slowing the pace of reducing their bond holdings, suggesting they are not concerned by a recent increase in inflation. While Jerome Powell reiterated that officials would like to see more evidence that prices are decreasing, he also stated that it would be suitable to begin easing “at some point this year.”

“The overall message from this ‘no news is good news’ press conference is that markets continue to have the green light to rise,” said Chris Zaccarelli at Independent Advisor Alliance. “This Fed is not going to hinder the bull market.”

The technology-heavy Nasdaq 100 increased by 1.2 per cent, with Apple Inc. and Tesla Inc. leading a surge in large-cap stocks. In late trading, Micron Technology Inc. presented a strong revenue forecast, bolstered by demand for artificial-intelligence hardware. Two-year yields dropped by eight basis points to 4.6 per cent. The dollar declined.

Some of the main movements in markets:

Stocks

- The S&P 500 increased by 0.9 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose by 1.2 per cent

- The Dow Jones Industrial Average rose by one per cent

- The MSCI World index rose by 0.8 per cent

Currencies

- The Bloomberg Dollar Spot Index fell by 0.4 per cent

- The euro rose by 0.5 per cent to US$1.0919

- The British pound rose by 0.5 per cent to US$1.2781

- The Japanese yen fell by 0.3 per cent to 151.24 per dollar

Cryptocurrencies

- Bitcoin rose by 3.1 per cent to US$65,714.01

- Ether rose by 2.9 per cent to US$3,375.02

Bonds

- The yield on 10-year Treasuries fell by two basis points to 4.27 per cent

- Germany’s 10-year yield fell by two basis points to 2.43 per cent

- Britain’s 10-year yield fell by four basis points to 4.02 per cent

- Fed holds rates, still signals 3 cuts in 2024

- BoC policymakers at odds over when to cut rates

- Bond traders surrender to higher-for-longer rates from

Commodities

- West Texas Intermediate crude fell by 2.1 per cent to US$81.68 a barrel

- Spot gold rose by 1.2 per cent to US$2,183.50 an ounce